China ’s Lithium Pursuits in Afghanistan’ s Political Economy : Sovereignty vs Foreign Exploitation

Abstract

Afghanistan is strategically located at the intersection of South Asia, Central Asia has huge untapped lithium reserves, a key resource in the world's transition to electric vehicles (EVs) and renewable energy. China's increasing interest in Afghanistan is notably gaining access to lithium to preserve its leadership in the EV battery supply chain. This article analyzes China's strategic interests in the region, emphasizing the change in regional power structures after the U.S. withdrawal in 2021. Despite the economic prospects, the paper highlights the difficulties China is encountering in Afghanistan. The analysis is further extended to the effect of China's lithium aspirations on India-Afghanistan relations, shaping regional geopolitics. The research assesses it as an economic lifeline or whether it is likely to turn into another instance of the "resource curse.

Keywords

Afghanistan, China, Electric Vehicles, Geopolitics, Lithium, Security Challenges

INTRODUCTION

Afghanistan, which sits at the crossroads to the Middle East and Central Asia, remains an important strategic point in South Asia. Geographically, China shares a limited border with Afghanistan but has a very old and deep connection with the state. Ties between China and Afghanistan date back centuries to the existence of the Silk Road in the second century. The Afghanistan sits on nearly one trillion dollars' worth of natural resources like iron and lithium. China is heavily interested and invested in lithium. The demand comes at the backdrop of the growing popularity of electric vehicles (EVs), which have become the symbol of technological advancement amongst the developed countries. Afghanistan holds immense geopolitical significance for China. The Chinese interests in Afghanistan are broadly two-fold- preventing the creation of a launch pad for Uighur militants and exploiting Afghanistan’s resources to boost its own economy.

MATERIALS AND METHODS

In our analysis of China strategic interests in the Afghanistan resource mines, through the meticulous scrutiny of official documents, policy statements, and academic papers, we gain insights into the objectives, strategies and investments of China. Our approach involved assessing policy goals and regional engagement environmental impact and this enabled us to identify ambiguity in existing potential issues and opportunities.

The researchers shed light on the evolving dynamics of regional and global geopolitics. Our findings underscore the significance of understanding the strategic calculations of China as it navigates this increasingly important region through this Mixed method study utilizing both Qualitative and Quantitative methods.

In this regard, the following works are analyzed in depth to offer a thematic review and delve into a deeper understanding of the lithium reserves as a non-renewable natural resource endowment.

Krishnan & Stanly (2022) in their work “The Comrades and the Mullahs: China, Afghanistan and the New Asian Geopolitics” published by HarperCollins, they critically analyse nurturing of economic engagement while avoiding overt economic adventurism by China maintaining close ties with the Taliban and emphasizes China’s interest driven approach in belt and road overtures and investment in Afghan infrastructure. However, the book omits the discussion of Chinese state-owned enterprises work abroad to secure lithium and focuses on copper, oil and geopolitical dynamics.

Swamy (2019) in his work “One Belt One Road: China’s emerging Afghanistan Dilemma” published by Surendra Publications, he critically explores China’s strategic placement of Afghanistan within its Belt & Road initiative especially for security, regional connectivity and relations with Pakistan and the Taliban. The book lacks in depth analysis of mining deal structures, Chinese firms’ roles and since the book was published prior to 2021, it misses the post-Taliban takeover deals and regulation.

Zhang (2025) in his work “A Neighbor of Neighbors: China’s Policy Toward Afghanistan” published by Palgrave Macmillan Singapore, he discusses the landmark lease granted to the China Metallurgical Group (MCC) for the massive MesAynak copper mine. Zhang notes China’s broader ambitions including railroad, fiber optics, and air corridors as necessary infrastructure investments. Despite global interest, lithium and other minerals like rare earth minerals are absent from the discussion and the focus remained on copper and there exists limited discussion regarding infrastructure challenges.

Manish and Kaushik (2023) in their work “China’s Interests in Afghanistan: An Assessment Post US Withdrawal” published by Sage Journals, analyses the 2021 US withdrawal and Taliban’s return wherein China was presented with a strategic opening into Afghanistan and exhibiting keen interest in extending the BRI infrastructure into Afghanistan to access its earth and lithium reserves. There exists insufficient exploration of the supply chain specifics and the article does not analyze how China is planning to mitigate investment risk.

Shah (2024) in his work “Mining for influence: China’s mineral ambitions in Taliban-Led Afghanistan” published by Wilson Center highlights China’s rapid economic and diplomatic outreach to Taliban post 2021 emphasizing China’s interest in lithium reserves pointing to site inspections by Chinese SOEs in late 2021 and the broader aims of these pursuits with China’s Global battery and EV ambitions. The analysis perceived Taliban rule as a continuation of existing projects but does not explore the negotiations or governance changes post 2021.

EFSAS (2024) in its work “China’s Risky Gamble on the Taliban” published by the European Foundation for South Asian Studies, discusses the existence of an estimated one trillion dollars’ worth of untapped minerals and lithium being critical for EV batteries. While reports mention the Gochin 10-billion-dollar plan, no official contract or any confirmation from either side are provided.

Patonia (2021) in his work “Lithium and an Unexpected Battle for Energy Transition in Afghanistan” published by The Diplomat, underscores the potential of Afghanistan with reserves and highlights the tension between Afghan sovereignty and foreign extraction deals and emphasized local concerns with foreign projects. Although initial export bans are mentioned, the evolution from ban to Taliban era contracts lacks detail.

Eurasian Review (2023) in its work “The Afghanistan Lithium Great Game” published by the Eurasia Review, it analyzed the Chinese mining interests filling the void left behind by the US withdrawal and the flocking of Chinese entrepreneurs for ‘19th century gold rush’ expeditions. The work is mainly focused on international maneuvering and lacks insight into how these lithium ventures impact local governance and communities.

Ali and Hale (2023) in their work “China, Afghanistan and the allure of ‘Green Mineral Development’” published by the Foreign Policy Research Institute, highlights the position of lithium as an essential for the global clean energy transition and suggests that Afghanistan could be its main source. It resumed that the Taliban might use these mineral deals to gain international acceptance. The article discusses infrastructure broadly but does not touch upon the Taliban assurances necessary for safe operations.

Akhter (2021) in his work “New perspectives on China’s evolving relations with Afghanistan” published by the Global Strategic & Security Studies Review, outlines Afghanistan’s road mineral wealth including cobalt, iron, copper, beryllium, and lithium. It maps Afghanistan’s oil reserves and natural case and interprets China’s posture as risk averse. The work misses recent developments including the CAPEIC’s 2023 oil deal or revisions to Mes Aynak coordination under Taliban Governance.

DISCUSSION AND RESULTS

China-Afghanistan Historical Ties

Historically, China has viewed Afghanistan to be of little importance. Back in the 1950s, the then Kingdom of Afghanistan was one of the first to recognize Mao Zedong’s China but the ties between the two countries were negligible. The withdrawal of The United States of America and the creation of a power vacuum in the region has surely intrigued China, but it has trodden carefully to Afghanistan. China had been dealing with insurgency in its Xinjiang province, home to the Uyghur Muslims. Traditionally, China has viewed Afghanistan as a low-priority neighbor in terms of diplomatic interests. However, with the withdrawal of the United States and the rise of the Belt and Road Initiative (BRI), Beijing’s approach shifted from deliberate detachment to a more strategically involved stance. 1 During the Taliban’s takeover in 2021, China was one of the four countries, including Russia, Iran, and Pakistan, that kept their diplomatic mission in Kabul. Hong called it a shift from “cultivated disinterest” to “growing engagement”.

The case of Afghanistan has been disorderly for decades. In 2001, following the 9/11 attacks and the Global War on Terror, the ruling Taliban- which had given shelter to Al Qaeda operatives- was thrown out. Fast forward twenty years later, the United States of America’s exit strategy kept the Afghan government out of the loop. The counter-narrative arises as China’s expanding role in Afghanistan post – U.S. withdrawal is influenced by the geopolitical vacuum left by the United States. While the U.S. military intervention aimed to counter terrorism and promote stability, its abrupt withdrawal in 2021 led to unforeseen consequences, including the rapid return of the Taliban.

The withdrawal was prompted by an early 2020 agreement between the Taliban and the Trump administration, which required the Taliban to refrain from sheltering terrorists who pose a threat to the United States as a condition for the pullout and its allies. 2 When the republic fell to the Taliban, the U.S. government halted all aid, severely crippling the Afghan economy and plunging the country into a humanitarian crisis.

The collapse of the Afghan Republic required immediate responses from the regional powers and the neighboring states as they aimed to engage with the newly established Taliban regime in Kabul. Rather than fostering long-term stability, the prolonged U.S. Intervention contributed to the proliferation of terrorist organizations, including Islamic State - Khorasan (IS-K). Prior to the fall of the Islamic Republic of Afghanistan, foreign aid constituted approximately 40% of the country’s Gross Domestic Product (GDP) and accounted for over half of the government’s $6 billion annual budget. Additionally, foreign assistance financed 75-80% of the total public expenditures which showcased the heavy reliance on external support for its economic stability. 3

The abrupt transfer of power in August 2021 triggered an immediate halt on international aid, leading to a rapid economic decline and a severe humanitarian crisis. In accordance with long-standing U.S. and United Nations (UN) sanctions against Taliban leadership wherein the United States and European nations froze nearly $9.5 billion (about $29 per person in the US) of Afghanistan’s external reserves. Consequently, the country’s central bank, Da Afghanistan Bank (DAB) was left without access to its financial assets and was cut off from the global financial system. Amidst increasing global and domestic demand for lithium, China has identified Afghanistan as a potentially significant source of this critical mineral pursuing investment agreements to tap into Afghanistan’s vast mineral wealth.

In January 2023, Xinjiang Central Asia Petroleum and Gas Co. (CAPEIC) finalized a $450 million agreement to explore and extract mineral reserves in northern Afghanistan. Additionally, since April 2023, negotiations have been underway for a $10 billion investment project focused on lithium exploration is expected to generate approximately 120,000 direct jobs and fund the development of key infrastructure. These initiatives align with China’s broader economic objectives, particularly to explain global influence through Belt-Road initiative. 4

Afghanistan sees the BRI as a crucial opportunity for economic growth, infrastructure development, and regional connectivity. 5 The government has confirmed its participation, recognizing the initiative’s potential to reshape global economic dynamics. Deputy Foreign Minister Hekmat Khalil Karzai emphasized that the Silk Road’s development will redefine international economic frameworks and significantly contribute to human progress in the 21st century.

China ’s involvement in Afghanistan

China maintained no official relations with the first Taliban regime (1996-2001) to guarantee security to the East Turkistan Islamic Movement. The ETIM had sought refuge in the Afghan state after attempting to establish a Uighur state in western China. Although the Taliban had given it the sought refuge, it promised not to let any anti-Chinese attacks be launched from the Afghan state. Despite the absence of official relations, think tanks and diplomats visited Kabul, and there were reports of Huawei and ZTE's involvement in the telecommunications system of Afghanistan. The Taliban regime also sought the easing of UN Security Council sanctions through Beijing. 6

The cards, however, came falling for the Taliban regime with the 9 September 2001 attacks on the Twin Towers in the US. The attack, which came early on in Republican President George Walker Bush’s term in office, largely defined America’s anti-terrorism policy, which was shaped and carried out under the banner of “Global War on Terror.” Following the attack, the obvious target became Afghanistan in which the Taliban had come to power in 1996 after a four-year struggle between rival mujahideen groups. Osama Bin Laden had come to Afghanistan that very year and the country provided al Qaeda with the base to recruit and train operatives. Tensions had been brewing between the US and Kabul when the 9/11 attacks were launched. This prompted the US to invade Afghanistan with the aim of eradicating terrorism. 7

During these years of turmoil in Afghanistan, China had maintained caution and distance from directly engaging with the country. It does not, however, mean that China did not maintain any ties. It had reopened its embassy in Kabul in 2002, which was followed by the signing of the Declaration on Good Neighbor Relations in December 2002 and the Treaty of Friendship, Cooperation, and Good Neighbourly Relations in June 2006. In 2012, the countries elevated their relationship to a strategic and cooperative partnership, teaming up for political, economic, humanitarian, security, international, and regional relations. Going ahead, China was concerned about security and stability in the region since the growing insurgency by the Taliban and then the Islamic State and al Qaeda had spillover effects into China’s 76-km-long border that it shares with Afghanistan. Additionally, the East Turkistan Islamic Movement, led by Uyghur Islamic extremists, has also launched attacks on the Chinese cities of Beijing and Kunming from its bases in Afghanistan. Afghanistan has thus proved to be a launch pad for many insurgent and terrorist groups, deeply undermining Chinese domestic security. 8

The Fragile States Index consistently ranks Afghanistan among the most fragile nations globally, underscoring its persistent vulnerabilities. The abrupt cessation of international aid led to a significant contraction of Afghanistan’s GDP, exacerbating poverty and unemployment. China’s Belt and Road Initiative offers opportunities to enhance Afghanistan’s infrastructure, promoting regional connectivity and economic growth. An inability to interact with other states as a full member of the international community is one of the most common attributes of state fragility.

After nearly two decades of war, the US exited Afghanistan, leaving behind a security, economic and humanitarian vacuum, creating many opportunities and challenges for China to play a regional role in Afghanistan. A stable Afghanistan is important for China, which has its Belt and Road initiative running through the former country. Moreover, a stable Afghanistan is needed for a recovery from the conflict-torn years towards development. China’s role as a passive player with a limited footprint in Afghanistan however is swiftly changing as it engages itself in the exploration of Afghanistan’s mineral resources wealth. However, China's relationship with the Taliban is like walking a tightrope while maintaining pragmatism. 6

The then Afghanistan’s mines minister Wahidullah Shahrani had quoted an untapped natural resources deposit of about $1 trillion. Reserves of such value can prop up a country’s fragile government, in this case, Afghanistan. Among the vast array of resources underneath Afghanistan lie necessary and critical rare earth minerals like lithium, and more than a decade ago, in 2010, the US government labeled Afghanistan the “Saudi Arabia of lithium”. 9

Afghanistan, being the eighth most mountainous country in the world, poses significant challenges in accessing many of its regions. The nation is estimated to hold over 2.2 billion tons of iron ore,1.3 billion tons of marble, and 1.4 million tons of rare earth materials. However, decades of conflict have prevented the exploration and extraction of much of these vast natural resources, leaving them largely untapped.

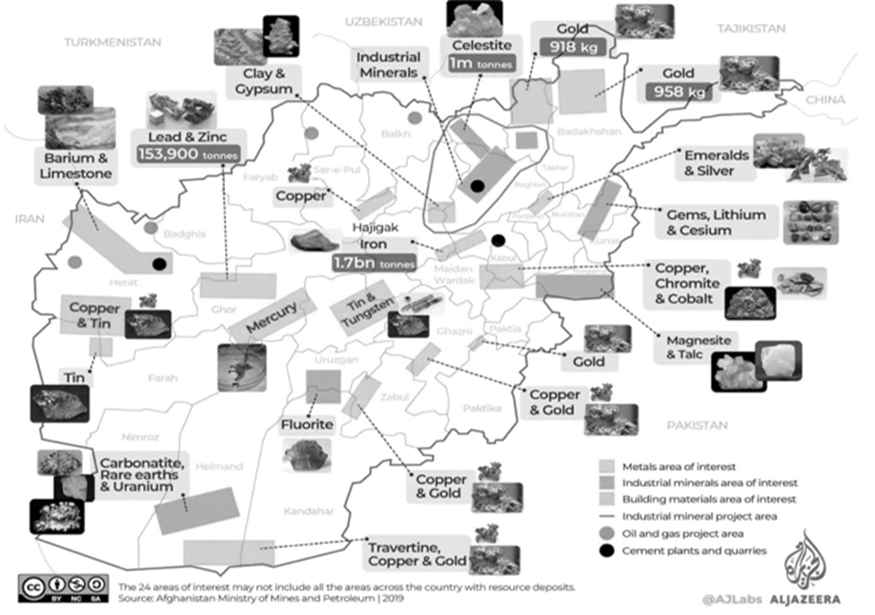

Back in the 1960s and 1970s, the USSR, along with its Eastern European allies, extensively conducted surveys to explore what was underneath the ground in Afghanistan. This, however, could not be done effectively since the country was marred by decades of violence. Only recently, in 2010, a comprehensive study was conducted by the United States Geological Survey (USGS) together with the Afghanistan Geological Survey (AGS). Herein, they identify 24 areas of interest across 34 provinces. 10 It was only recently that the lithium reserves were found and identified, giving a boost to the scramble for materials essential for the green energy transition.

The uses of lithium are aplenty across various technologies. Lithium, lightweight and very reactive to oxygen, is a superconductor and has found its way into technologies like electric vehicles (EVs), cell phones, televisions, computers, fiber optics, and pharmaceutical products. It is also used as an active ingredient for nuclear weapons. It is expected to be categorized as a critical raw material by the British Geological Survey. 11 Since coming to power in 2021, the Taliban celebrated its first 25-year energy deal worth $514 million with Beijing earlier this year. But China has not limited itself to Kabul’s energy sector but has shown keen interest in its mineral resources industry as well.

The eastern end of the country, particularly Nuristan and Konar, offers reserves of lithium, which is geographically strategic for China as it shares a limited border very close to this region. This makes the extraction and transportation of lithium to China easy, saving it the cost of transportation of the minerals. Since the signing of a Memorandum of Understanding (MoU) between Afghanistan and China in 2016, it has been established that the former would be incorporated into China’s ambitious Belt and Road Initiative (BRI). 1 Tapping into Afghanistan’s large lithium deposits will not only help in the green-energy transition but will also help China to take advantage of the vacuum created since the US exited the country in 2021. Afghanistan's entry into China's Belt and Road Initiative (BRI) and the Five Nations Railway Project has important strategic, economic, and geopolitical connotations. With its geographical position at the intersection of South Asia, Central Asia, and the Middle East, Afghanistan is a key transit point for regional connectivity. Its inclusion in these projects is not merely an issue of infrastructure; it reorders regional power relationships, economic interdependencies, and security considerations.

The new Silk Road was envisioned as a means to integrate Afghanistan more deeply into region and support the reconstruction of vital infrastructure damaged by decades of war and conflict. China has approached the vision by establishing a rail-based route into Afghanistan through Tajikistan and Uzbekistan. This initiative includes offering the Taliban administration tariff-free access to Chinese construction, energy, consumer markets, signaling a strategic economic partnership. The inclusion of Afghanistan in the BRI strengthens China's regional influence. The Five Nations Railway Project (China-Kyrgyzstan-Tajikistan-Afghanistan-Iran) enhances China's westward connectivity by circumventing Pakistan and providing China with direct access to Iran and the Middle East. This eroded India's presence in Afghanistan, especially since New Delhi had been developing Chabahar Port to neutralize China's regional hegemony. If the railway is linked with Iran's Bandar Abbas, Afghanistan could become a major hub in China's Middle Eastern trade chains, further tightening Beijing's economic grip.

From a Central Asian viewpoint, Tajikistan and Kyrgyzstan gain from better access to China, but it also makes them economically more dependent on Beijing. The two states already have considerable debt liabilities to China, and future infrastructure schemes could make Beijing even more influential in their economic and foreign policies. Iran also has strategic benefits by linking to China's trade network in the face of Western sanctions, making it stronger against U.S. economic pressure. Afghanistan is rich in natural resources, including rare earth minerals, lithium, copper, and iron—critical for modern technology. China’s investment in Afghan infrastructure is likely motivated by securing access to these resources, aligning with its global strategy of controlling supply chains for critical minerals. The railway project could facilitate China’s access to Afghanistan’s mineral wealth, reducing Western and Indian competitors’ influence in the sector.

Afghanistan, on its part, enjoys economic dividends from connectivity initiatives at the cost of economic dependence on China. Chinese infrastructure loans and investments may bring about a kind of China's "debt-trap diplomacy" where states are unable to repay loans, providing Beijing long-term strategic leverage over key infrastructure. The train journey through Tajikistan and Afghanistan, both historically unstable countries, is a cause of security concern. China has already expanded its security presence in Tajikistan, and the railway would be an excuse for further Chinese military and intelligence engagement in the region. The presence of Uighur separatists and Islamic extremist groups in the Afghanistan-Pakistan border region also gives security as a high priority for China. In case the railway is affected by instability, China would demand increased direct engagement in Afghan issues. 12

For Afghanistan, the rail brings possible economic security, yet political alignment with Iran and China risks alienating India and Western powers, circumscribing alternative alliances. Pakistan's exclusion from the Five Nations Railway also recalibrates regional balances of power. While China has made inroads in Pakistan with the CPEC (China-Pakistan Economic Corridor), an alternate route via Afghanistan gives Beijing greater leeway and diminishes reliance on the shaky political ground in Pakistan. Five Nations Railway and Afghanistan's inclusion in the BRI are not merely economic initiatives but strategic ploys to alter power equations in the Indo-Pacific, Central Asia, and the Middle East. China becomes the preeminent economic power, with India and Western nations at risk of being edged out. Afghanistan, while benefiting, runs the risk of excessive dependence on Chinese investment, with long-term implications for sovereignty and economic freedom. 12

Although Afghanistan’s trillion-dollar reserves were identified over a decade ago, its effective use has been missing due to massive corruption and an unstable political climate. According to reports, the Afghanistan government has lost about $300 million in revenue from mining every year. Earlier this year, the Special Inspector General for Afghanistan Reconstruction, in its report, called the US’s efforts for about seventeen years to revamp Afghanistan’s extractives industry as “negligible” and “not sustained”. The main challenges were pertaining to corruption, Afghanistan’s inability to reform its mineral policies and regulations, its suspension from the Extractive Industries Transparency Initiative, lack of infrastructure and security concerns. 13

China ’s Economic Interests in Afghanistan: Strategic Implications and Geopolitical Challenges

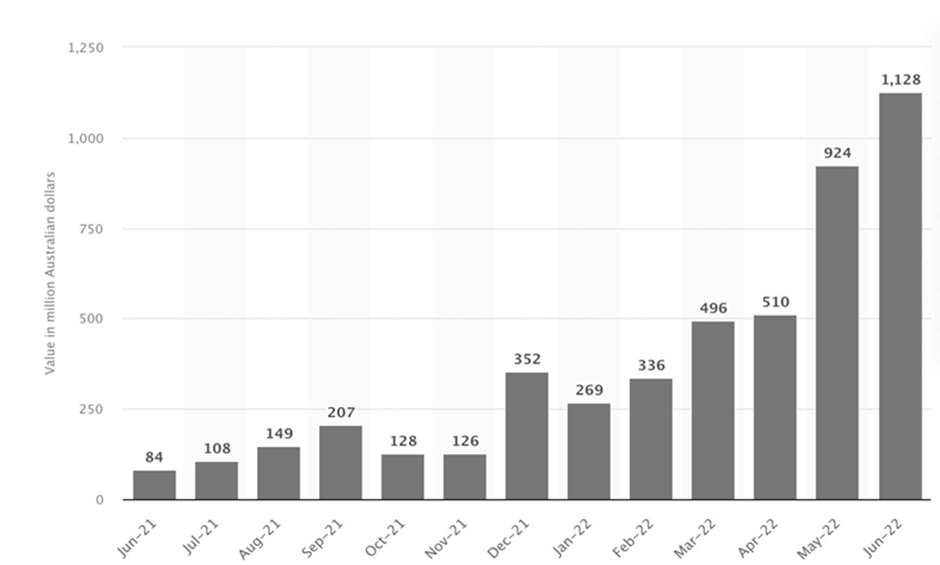

The overwhelming majority of sales of electric vehicles is concentrated in three markets- China, Europe and the US. Out of these, China is the frontrunner, accounting for 60% of global electric car sales taking place in 2022, and more than half of the EVs in the world are currently in China. 14 However, most of China’s lithium is imported, which can cause security governance issues in its lithium supply chain. 15 Study shows that China's consumption was 86.7 kilotons of lithium carbonate in 2015, accounting for exactly half of the global demand for lithium. However, about 70% of China’s lithium is imported from Australia alone.

While electronic chips and equipment are key to this transition, the fountainhead for this change are minerals such as lithium, cobalt, graphite and other ‘rare earths. These minerals are the foundation for the whole electric mobility supply chain which countries such as China are pursuing aggressively. China dominates this supply chain through a belligerent geo-economic policy of sourcing, extracting and refining these minerals from various parts of the world. The Washington Post reported recently that nearly a trillion dollars' worth of a vast wealth of lithium and other minerals have been found in the Hindu Kush Mountain range in Nuristan. It is little wonder that China is working closely with the Taliban regime to gain access to this strategic asset.

China’s increasing demand for lithium has driven it to secure supplies from multiple regions, ensuring control over the global battery supply chain. Australia remains China’s largest lithium supplier, providing nearly 60% of its lithium imports, followed by South America’s Lithium Triangle (Chile, Argentina, Bolivia) and emerging suppliers in Africa (Zimbabwe, DRC). While these sources support China’s lithium refining dominance, accounting for over 70% of global lithium processing, geopolitical uncertainties and rising resource nationalism in lithium-rich countries have prompted China to seek alternative reserves. Afghanistan has emerged as a strategic target due to its vast untapped lithium deposits, potentially worth over $1 trillion. As global competition for critical minerals intensifies, China aims to integrate Afghanistan’s resources into its supply chain through Belt and Road Initiative partnerships. 9

The Taliban Government, facing economic isolation and Western sanctions has welcomed Chinese investment, offering Beijing exclusive access to mineral extraction rights. However, security risks and geopolitical and infrastructural limitations challenge large-scale mining operations. Despite these hurdles, China’s interest in Afghan lithium highlights its broader strategy of securing critical raw materials reducing reliance on Western, aligned suppliers, and maintaining dominance in the global Electric Vehicle industry.

In June 2022, China imported approximately 1.13 billion Australian dollars’ worth of lithium from Australia, accounting for 97% of Australia’s total lithium exports that month. Throughout the year, China consistently remained the dominant importer, receiving at least 85 percent of Australia’s lithium exports each month. China has emerged as the global leader in electric vehicle production and adoption, fueled by a combination of policy incentives, technological advancements, and resource control. The dominance not only drives the global EV market but also reshapes geopolitical dynamics. China’s government has played a pivotal role in fostering the EV Boom through subsidies, tax breaks, and investment in charging infrastructure. The introduction of the New Energy Vehicle (NEV) mandate ensures domestic automakers prioritize EV production, making China home to over half of the world’s EVs by 2023. These policies aim to secure energy independence and reduce reliance on oil imports, aligning with broader economic and strategic goals. China’s technological edge is underscored by its dominance in battery production, with companies like CATL and BYD accounting for 60% of the global battery supply. This leadership is bolstered by cost efficiencies and economies of scale, allowing Chinese automakers to export EVs competitively. For instance, Europe and Southeast Asia are key destinations for Chinese-made EVs, giving Beijing leverage in international trade. 16

China’s control over critical raw materials, such as lithium, cobalt, and rare earth elements, further cements its position in the EV supply chain. Through investments in mining operations in Africa and South America, China has created a vertical integration model, reducing dependency on external suppliers. The rise of China’s EV sector signals a shift in geopolitical power from traditional oil-exporting nations to renewable energy and EV technologies. By influencing global supply chains and setting industry standards, China challenges the technological supremacy of the West, particularly the United States. Simultaneously, its BRI initiative integrates EV infrastructure projects, enhancing regional influence. China’s EV boom is not merely a domestic industrial success but a strategic maneuver reshaping global energy and geopolitical landscapes. Its dominance redefines power dynamics, emphasizing the transition from fossil fuels to renewable energy systems.

Afghanistan, known for its mineral wealth, has a history of informal lithium mining. Soviet-era geological surveys in the 1970s identified lithium deposits in provinces like Nuristan, Badakhshan, and Ghazni. However, geopolitical instability hindered large-scale mining. By the 2000s, illicit trade networks smuggled lithium ore to Pakistan and China, depriving Afghanistan of economic benefits. In the 2010s, global lithium demand intensified manual extractions while transnational smuggling networks became more organized. Post 2021, Taliban-led Afghanistan has acknowledged lithium’s potential but struggles with weak regulation, persisting smuggling, and environmental damage. Key provinces like Herat, Ghazni and Nimroz have been identified as promising regions for lithium-rich pegmatite formations. Lithium's significance lies in its pivotal role in producing batteries for EV and renewable energy storage systems, essential for global decarbonization efforts. The International Energy Agency (IEA) predicts 40 40-fold increase in lithium demand by 2040. Despite its immense potential, challenges such as political instability, infrastructure deficits, and illicit trade hinder sustainable development. 17 China’s economic engagement with Afghanistan is driven by resource acquisition, investment, and strategic connectivity. Through Build, Operate, and Transfer (BOT) agreements, China secured the Mes Aynak Copper Project, and in January 2023, Xinjiang Central Asia Petroleum and Gas co (CAPEIC) signed a $540 million contract to extract oil from Amu Darya Oil Basin, reinforcing its access to vital minerals and energy resources. 18 It has provided substantial aid, including a $76 million technical cooperation agreement in 2016. While maintaining a non-military stance, China positions itself as a diplomatic mediator, countering Western influence after the US withdrawal. Afghanistan’s integration into the Belt and Road Initiative via the China- Pakistan Economic Corridor (CPEC) enhances trade routes, securing China’s economic interests under Taliban rule.

China’s strategic focus on Afghanistan’s lithium resources could significantly impact Afghanistan’s relations with India, especially given the ongoing tensions between the two nations. Since the U.S. withdrawal in 2021, China has actively pursued Afghanistan’s lithium reserves, while India has also shown interest in securing lithium as part of its Sustainable Development Goals (SDG) and EV production targets by 2030. Afghanistan faces a dilemma between welcoming foreign investments for economic growth and prioritizing national sovereignty and local development. Increased Chinese investments could deepen Afghanistan’s economic reliance on Beijing, potentially diminishing India’s influence in the region. 19

Lithium, classified as a “Strategic mineral”, is 100% import-dependent in India, making it a high-priority resource. India aims to establish a robust electric vehicle (EV) ecosystem, where lithium is a crucial component. Battery technology plays a vital role in India’s green energy transition, economic growth, and its target of net-zero emissions by 2070.However, India faces significant challenges, including the lack of a secure and independent supply chain for lithium and related technologies.

The Chinese Ambassador to Afghanistan also stated that China will offer Afghanistan zero-tariff treatment for 100% tariff lines, the tariff-free access being applicable to its construction, energy and consumer sectors. Although Beijing has refrained from formally recognizing the Taliban like various other governments, the impoverished country could be of great benefit to boost Beijing’s supply chain security with their offer of extensive mineral resources. 9

Afghanistan ’s state fragility and its impact on local communities

The study conducted by Amanda Löfström found that Afghanistan's economy heavily relies on international aid, which has negatively impacted the country's agency and distorted state-citizen relationships, creating a rentier state. Dependency on aid has relieved the Afghan state from financial accountability, enabling it to operate without considering citizens' demands, further distorting their relationship. Despite some advancements, like progress in gender equality and maternal mortality reduction, Afghanistan still faces considerable challenges. The influx of massive aid created a separate public sector, creating tensions between the state and donors and diverting citizen reliance towards aid organizations instead of the state. Centralization of political power in the Afghan president's hands, alongside substantial aid inflows, fosters corruption, distrust, and patronage, undermining the state's legitimacy. 20

The Taliban’s most pressing challenge which significantly impacts the welfare of the Afghan people is establishing sustainable governance, especially amid a looming humanitarian crisis. The dramatic decline in security as well as increased political and economic volatility have had a damaging effect on the enforcement of rule of law and human rights for Afghans. The civil society’s expectations remain quite focused on necessities entailing access to food, potable water, electricity, security and a reliable justice system. The political scenario of corruption and exploitation has marginalized civil society and created a lack of accountability. 21

The Taliban regime confronts a spectrum of global challenges spanning economic, humanitarian, and security domains. These challenges could potentially impact the stability and legitimacy of their governance. The regime faces economic hurdles due to a lack of international recognition and aid. This shortfall could impede their ability to provide essential services to the populace and finance their governance. High levels of poverty, displacement, and vulnerability pose significant humanitarian challenges. These factors might exacerbate existing social and political tensions within the country. The Taliban regime encounters security threats from internal dissidents, regional terrorist factions, and global powers. These threats might hamper their capacity to control the country and establish diplomatic ties with other nations. While the Taliban's challenges mirror those faced by previous regimes, changes in the global political and security landscape introduce new complexities. The challenges confronted by the Taliban regime hold substantial implications for regional security. Potential spillover effects like increased terrorism or refugee flows could arise.

Afghanistan has long been recognized for its vast reserves of mineral resources, including lithium, which holds significant economic potential. The Taliban administration asserts that the proposed lithium agreement could create approximately 120,000 direct jobs, along with numerous indirect employment opportunities, at a time when the country is grappling with a severe humanitarian crisis. As a part of this agreement, China has committed to investing in new infrastructure projects, potentially contributing to Afghanistan’s broader economic development. There remains speculation that China’s involvement in Afghanistan’s mineral sector could serve as a diplomatic lever in advocating for improved human rights conditions, particularly concerning the rights of women and girls. 22

The Taliban authorities have intensified restrictions on local media and freedom of expression, resulting in an increase in arbitrary detentions of journalists, human rights defenders, and civil society activists, including female protestors. Additionally, the December 24, 2022, directive prohibiting women from working with local and international non-governmental organizations (NGOs) except in roles related to health, nutrition, and education has significantly impacted women’s economic participation. This restriction has further compounded the ongoing humanitarian crisis by hindering the effective distribution of aid and limiting the ability to assess and address the specific needs of women and girls, who often face greater barriers in accessing essential resources such as food and humanitarian assistance.

The Mes Aynak mining site, located in the Baba Wali Mountains, encompasses a vast archaeological complex that includes an ancient Buddhist monastery spread across multiple hills and spanning over 100 acres. 23 This historically significant site is situated directly above an estimated $80-100 billion worth of copper and other valuable minerals, making it a focal point for both economic exploitation and heritage conservation efforts. Unlike the policies of the previous Taliban regime, the current de facto Taliban government has expressed its commitment to preserving the archaeological remains at Mes Aynak. There have been warnings and opinions that such agreements may facilitate corruption, mismanagement, and severe environmental degradation, raising critical questions about the balance between economic development and the protection of Afghanistan’s cultural heritage.

The shared perception of the United States as a common adversary has tremendously contributed to the growing ties between the Taliban and China while Pakistan serves as a crucial link between them especially due to its early recognition of the Taliban’s first regime. The withdrawal of Western powers from Afghanistan has opened the door for China to expand its influence across South and Central Asia. The Taliban’s control over Afghanistan’s lithium is particularly important for China, given its dominance in electric vehicle battery and solar panel production along with its status as the world’s largest lithium importer. Despite the ongoing security concerns regarding the Uyghur-related extremism, China is prioritizing its economic interests in Afghanistan. 24

China’s mining influence in Afghanistan underscores a strategic convergence of long-term ambitions and geopolitical interests, as it leverages the power vacuum left by the U.S. withdrawal to strengthen its economic foothold and expand regional dominance.(Shah,2024) Afghanistan's fragile security situation and the presence of militant and terrorist groups continue to pose major challenges to foreign investment, particularly since any kind of investment requires a stable environment and political stability are essential for the success of large-scale projects. One potential hurdle for mining operations is the local resistance as the communities may be wary of the presence of foreigners and over concerns about the environmental and social consequences of natural extraction. However, an advantage still remains the Chinese investing in the mining sector could help mitigate such issues by fostering economic growth and generating employment opportunities for the local population. 24

India ’s Strategic Interests in Afghanistan

The India- China rivalry could extend into Afghanistan, leading to heightened geopolitical tensions. China currently controls 60% of the global lithium supply, making India highly dependent on Chinese imports. With growing tensions, this reliance could result in supply disruptions and higher costs for India’s EV industry. If India successfully gains access to Afghan lithium, it could reduce dependence on China, strengthening its supply chain security. Additionally, greater engagement with India could benefit Afghanistan by bolstering the Taliban’s efforts for international legitimacy, positioning Afghanistan as a key player in global mine trade. 25

China currently dominates the global lithium processing industry, accounting for almost 60% of the world’s capacity. Gaining Access to Afghanistan’s lithium reserves could offer India a strategic alternative, reducing its reliance on Chinese imports and bolstering the supply chain for its growing electric vehicle (EV) sector. By 2030, India Expects its annual demand for lithium carbonate to reach 56,000 metric tons to meet the needs of its EV industry. Lithium-ion batteries, which power EVs also play a major role in renewable energy by balancing and storing energy and electrical supply. From the Taliban’s viewpoint, initiating cooperation with India in lithium mining brings several potential benefits. Economically, it represents an opportunity to generate revenue and secure foreign investment which is crucial for a nation facing economic isolation and severe infrastructure discrepancies. Diversifying its international partnerships by engaging with India, rather than relying solely on long-standing allies like China, could potentially attract wider investments and could aid in strengthening the Taliban’s pursuit for international recognition and legitimacy.

India has undertaken several smaller-scale initiatives in Afghanistan through its Small Development Projects (SDPs), focusing on grassroots-level development. Additionally, India has prioritized capacity building by offering scholarships and training programs for Afghan civil servants, deploying 20 technical advisors in Afghan ministries under a UNDP trilateral agreement, and training Afghan security personnel. 26 A key feature of SDPs is their decentralized approach, which emphasizes Afghan ownership and local participation.

Afghanistan’s industrial and manufacturing sectors present potential investment opportunities for Indian business, especially since Indian products and services tend to be more affordable compares to those from western countries. A major hurdle remains the limited availability of skilled labor in Afghanistan. This challenge could be addressed by India expanding its Small Development Projects (SDPs) to include vocational training programs aimed at enhancing the skill set of the Afghan workforce. 27

CONCLUSION

Afghanistan’s instability poses a major threat to China’s Silk Road Economic Belt (SREB), a vital land corridor linking China to Europe and Africa. Taliban offensives, terrorist activities, and regional insecurity disrupt trade routes, deter investment, and endanger China’s One Belt One Road (OBOR) initiative, undermining Beijing’s economic and strategic ambitions.

China's resource extraction interest in Afghanistan faces significant security challenges due to ongoing insurgencies and government instability. Since the Taliban's takeover in 2021, groups like Islamic State-Khorasan Province and National Resistance Front continue to pose threats. IS-KP, which has expanded into Northern Afghanistan and carries out cross-border attacks, made target Chinese Investments, given its history of attacking Chinese nationals in Pakistan. The NRF, focused on Taliban forces operates in regions with potential Chinese projects risking indirect disruptions. The Taliban's inconsistent securities strategy, highlighted by the US drone strike on Al - Al-Zawahiri, raises concerns about their ability to ensure investment safety. their counter-insurgency measures, including mass detentions and ethnic reprisals could fuel further unrest. Border Security remains fragile, with IS-KP attacks on Tajikistan potentially impacting China's Western Frontier. additionally local resentment towards Chinese resource projects or extortion. given these risks Chinese investments may face operation uncertainty, risking security cost and potential disruptions. with robust security guarantees from Taliban, China may adopt a cautious approach. 28

Afghanistan’s vast mineral wealth presents both economic opportunities and governance challenges. Lessons from global mining experiences highlight the risks of environmental degradation, weak regulatory framework, and socio-political conflicts that Afghanistan must address to ensure sustainable resource management. Environmental damages, including deforestation, water contamination, and land degradation have been a major consequence of unregulated mining in regions such as Latin America. Afghanistan, already facing water scarcity and a fragile ecosystem, must implement strict environmental regulations and rehabilitation measures to prevent long-term ecological harm. 29

Governance challenges, particularly corruption and unequal resource distribution have fueled conflicts in resource-rich but politically unstable nations. Afghanistan risks falling into the resource curse unless transparency mechanisms and equitable revenue-sharing policies are enforced. Formalizing artisanal and small-scale mining (ASM), which often operates in legal uncertainty, could improve labor conditions while reducing illicit trade and armed group financing. Afghanistan could play a significant role in the global energy transition due to its enormous lithium reserves. However, resolving intricate geopolitical, economic, and security issues is still necessary for it to effectively utilize this resource. Beijing's larger aim to secure vital minerals for its electric vehicle (EV) and renewable energy industries is reflected in China's growing engagement in Afghanistan's mining sector through investments and infrastructure development under the Belt and Road Initiative (BRI). Such alliances generate issues regarding sovereignty, regulatory supervision, and long-term viability even though they also offer economic potential.

If the resource-driven economic model is poorly managed, Afghanistan may fall victim to the well-known "resource curse," in which income derived from natural resources worsens economic reliance, conflict, and corruption rather than promoting development. Historical precedents from mineral-rich but politically unstable regions, such as the Democratic Republic of the Congo and Latin America, underscore the importance of establishing robust governance mechanisms, transparent revenue-sharing policies, and environmental safeguards. 30 Without these, Afghanistan risks perpetuating illicit trade networks, ecological destruction, and geopolitical vulnerabilities.